eNotes: Workers’ Compensation – September 2020

September 02, 2020

PENNSYLVANIA CASE LAW UPDATE

Protz Update

Both the Commonwealth and Supreme Courts have, in recent weeks, circulated opinions further clarifying particular aspects of IREs in the aftermath of Protz.

Constitutionality of Act 111: Perhaps most critically, in an opinion issued on June 16, 2020, the Supreme Court – with a one sentence order – confirmed the constitutionality of Act 111. Specifically, the Court affirmed the Commonwealth Court’s opinion in Pennsylvania AFL-CIO v. Commonwealth, wherein the court had determined that Act 111 does not represent an unconstitutional delegation of legislative authority.

Proper Date of Reinstatement: The Supreme Court further held, in Dana Holding Corp. v. WCAB (Smuck), that Protz applies to all cases which were pending on appeal at the time the opinion was circulated and where IRE constitutionality was appropriately raised. Further clarification as to the proper application of Smuck and Whitfield in various cases was subsequently offered by the Commonwealth Court on August 17, 2020. The court held that, in matters where the underlying IRE was still being actively litigated when Protz was decided, Smuck controls, and permits the reinstatement of TTD benefits retroactive to the date of the IRE. Conversely, where a claimant was not actively litigating the underlying IRE when Protz was decided, Whitfield applies, and the proper date of reinstatement, if such an entitlement is established, is the date of the petition to reinstate.

Validity of Pre-Act 111 IREs: In a decision issued on August 17, 2020, the Commonwealth Court held that IREs obtained prior to the enactment of Act 111 (October 24, 2018) are invalid, notwithstanding the fact that the impairment rating might have been rendered pursuant to the Sixth Edition of the AMA Guides. The court rejected any retroactive application of Act 111, and instead held that if an employer seeks to modify a claimant’s benefit status, a new IRE must be convened under the authority of Act 111.

Neves v. WCAB (American Airlines), 2020 WL 2501028 (Pa. Cmwlth., No. 1431 C.D. 2018, Filed May 14, 2020)

The Commonwealth Court has held that 20% contingent attorneys’ fees are per se reasonable not only with regard to indemnity payments, but with regard to medical payments as well.

Background: In reviewing prior case law, the Court did not expressly overrule past precedents related to reasonableness of fees on medical benefits, but found that the same were fragmented and inconclusive. At the very least, those precedents had established that: (1) counsel fee should be calculated against the entire award, without regard to whether the award is for medical or indemnity compensation; and (2) the terms of the fee agreement govern, and it is incumbent upon the claimant to establish that the parties intended that the counsel fee be applied to the entire award, including medical compensation.

Legal Analysis: The court concluded, “that Section 442 does not distinguish between the type of compensation awarded; does not require an inquiry into the reasonableness of a 20% fee agreement; and does not make the amount and degree of difficulty of the work performed by the attorney relevant. A 20% counsel fee is per se reasonable.”

Takeaway: Neves creates a number of potential complications with regard to an employer’s compliance with approved fee agreements. To this end, it is now clear that, where a claimant establishes that he or she intended for the attorneys’ fee to be applied to the entire award, including medical compensation, and the fee agreement reflects such terms, a 20% fee will be considered per se reasonable on both indemnity and medical benefits. For this reason, it is now critical to clarify at the outset of litigation whether the claimant’s attorney is seeking 20% of medical benefits pursuant to the controlling fee agreement. If so, it is most prudent that the WCJ include corresponding language in an order approving the agreement, so as to insulate the employer from potential challenges from medical providers in the fee review forum.

Stahl v. WCAB (East Hempfield Twp.), Pa. Commw. No. 1575 C.D. 2020, filed August 14, 2020, 2020 WL 4723100 (Pa. Commw. 2020) (Stahl II)

In a case spearheaded by Thomas, Thomas & Hafer LLP attorney James A. Tinnyo, the Commonwealth Court has affirmed, after its own June 2018 remand, that a volunteer firefighter failed to act with due diligence in providing notice of injury to his employer after developing stomach cancer.

Background: The claimant became a volunteer firefighter for employer in 2002. In 2006, he was diagnosed with stomach cancer. He underwent surgery and incurred medical bills, experiencing a period of disability of six weeks. During that 2006 period of disability, “he suspected that there might be a connection between his firefighting duties and his stomach cancer.” He ultimately ceased working for the employer in 2008.

In 2011, Act 46 came to his attention. He acknowledged that, after reading about the law, he again suspected a connection between his service as a firefighter and his cancer diagnosis. He sought out an attorney and entered into a fee agreement with the same in August 2012. Then, in September 2014, a doctor confirmed the claimant’s belief as to causation. This was the first point in time claimant received any indication from a doctor that his service as a firefighter caused his cancer. Claimant then filed a claim petition.

That initial round of litigation resulted in the WCJ granting benefits, having found that the claimant had provided effective notice. The employer appealed, and, in a June 2018 opinion, the Commonwealth Court remanded. At that time, the court sought to emphasize that the requisite 120-day notice period does not, as a rule, only begin to run upon a doctor’s informing a claimant of the work-relatedness of his or her condition. The court remanded for a finding as to whether the claimant had exercised “reasonable diligence” in obtaining that very medical opinion. On remand, the WCJ in fact found that the claimant had not exercised reasonable diligence and thus denied the petition. The Claimant appealed, and the WCAB affirmed.

Legal Analysis: On appeal to the Commonwealth Court, for the second time, the claimant argued that in an Act 46 case, notice should only begin its run once a physician provides a report confirming diagnosis and work-related causation. The court, however, responded that it had rejected this argument in its first consideration of the case and refused to revisit the issue.

Claimant also asserted that the WCJ should not have considered claimant’s inaction between the date when he secured counsel and when he finally received a medical report, as this period of time encroached upon the non-discoverable aspects of the attorney-client relationship. The court, however, rejected this assertion, stating that, “The attorney-client privilege protects the disclosure of communications; it does not protect the disclosure of the underlying facts.”

Takeaway: With its most recent opinion, the Commonwealth Court has made clear that, in order to establish timely notice in the occupational disease context, a claimant must (1) provide notice within 120 days of sufficient knowledge of the work-relatedness of his or her disease; and (2) must also exercise reasonable diligence in attaining that knowledge.

Sutter v. WCAB (Kelly Services, Inc.), Pa. Commw. No. 1364 C.D. 2019, filed August 12, 2020, 2020 WL 4642143 (Pa. Commw. 2020)

The Commonwealth Court has affirmed the decision of a WCJ and the Appeal Board, denying the claimant’s petition to set aside her Compromise and Release Agreement.

Background: The claimant alleged an injury to her back, sustained while walking up a staircase. The employer contested the claim, but during the pendency of the litigation agreed to pay a lump sum. The WCJ approved a release of all liability. During this first round of litigation, claimant was represented by counsel. Ten weeks later, the claimant, now pro se, filed to set aside the C&R. She maintained that, since the C&R, she learned that she would have to undergo back surgery. In a hearing which followed, she testified that it was only after the C&R approval hearing that she had learned of the need for surgery.

Legal Analysis: The WCJ, Appeal Board, and Commonwealth Court all denied the set-aside attempt. The claimant did not allege or prove fraud, deception, duress, or mutual mistake. The court, however, denied the employer’s demand for frivolous appeal fees.

Takeaway: While a rather simple case, on its face, Sutter is a worthwhile reminder of the importance of compromise and release hearings in Pennsylvania. Unlike some jurisdictions, our Commonwealth requires a hearing before a WCJ for the presentation of each and every Compromise and Release Agreement entered into by parties. Such a hearing ensures that, if set-aside is later attempted, a record exists to establish that the claimant previously voiced his or her understanding, in full, of the agreement at the time it was entered into.

Griffis v. WCAB (Albert Einstein Healthcare Network), Pa. Commw. No. 273 C.D. 2019; 280 C.D. 2019, filed July 15, 2020, 2020 WL 3989478 (Unreported, Pa. Commw. 2020)

In an unreported opinion, the Commonwealth Court held that payments of compensation made to a claimant between the date of a third-party medical malpractice recovery and the WCJ’s ultimate approval of subrogation constituted future, rather than past, benefits as contemplated by the court’s prior analysis in Whitmoyer.

Background: The claimant had sustained a work-related injury in April 2009. During initial treatment, her spinal cord injury was not properly diagnosed or treated, leading to surgery which ultimately resulted in neurological dysfunctions. The claimant filed a medical malpractice action against her doctors, and later received an award of $2.4 million. In August 2017, a WCJ found that the employer had indeed met its burden of proof to establish an entitlement to subrogation. After a cessation of indemnity payments, in December 2017, the employer filed modification and suspension petitions, seeking to preserve its subrogation rights. The WCJ found that the employer was entitled to a future credit for the balance of recovery over the grace period, pursuant to a Third Party Settlement Agreement which had been executed. The Board affirmed.

Legal Analysis: On appeal, the Commonwealth set forth an extensive and detailed review of the impacts of Section 319 of the Workers’ Compensation Act, Section 508 of the MCARE Act, and both Whitmoyer and Protz upon an employer’s right to subrogate a third-party award in a medical malpractice action arising from a work-related injury. As the court explained, the crux of the issue before it was the claimant’s view that payments of indemnity and medical benefits made on her behalf between April 2013 and the 2017 WCJ decision constituted past, rather than future, payments of medical expenses and lost earnings that were not subrogable pursuant to the MCARE Act and Protz.

The court determined that, because more than four years elapsed between the date of the claimant’s third-party recovery and approval of the employer’s request for subrogation, the employer in fact paid four years’ worth of future benefits. For this reason, the benefits were indeed subject to subrogation.

Takeaway: Though a complex opinion by the court, Griffis can be relied upon for the simple proposition that payments of compensation made between the date of a claimant’s third-party recovery and a WCJ’s ultimate grant of subrogation constitute future payments of compensation and are therefore subject to subrogation – even in the medical malpractice context.

VIRGINIA CASE LAW AND STATISTICAL UPDATE

Loudoun County v. Richardson, 841 S.E.2d 629 (2020)

In an opinion delivered by Justice Mims, the Supreme Court of Virginia has held that, when a claimant receives a prosthetic device that improves functionality (like a hip replacement), the permanent loss of use is calculated before the implant, and not after.

Background: The claimant, a fire battalion chief in the Loudoun County Fire & Rescue Department, was injured during a firefighter evaluation exercise. Following a hip replacement surgery, the treating physician opined that the claimant’s loss of use of his left leg was 11 percent. In response to a questionnaire, the same doctor opined that claimant’s loss of use rating prior to the hip replacement surgery was 74 percent. The claimant filed a claim for benefits which initially alleged an 11 percent loss of use, but he later amended the claim to reflect a 74 percent loss of use.

The Deputy Commissioner awarded permanent disability benefits, assigning a rating based on the 74 percent loss of use opinion, not the 11 percent rating, and the Full Commission upheld the 74 percent rating. The Court of Appeals similarly upheld, holding that loss of use is calculated before any surgery that improves functionality by use of a prosthetic device. Loudoun County appealed to the Supreme Court of Virginia, which followed suit and affirmed the lower courts’ decision.

Legal Analysis: The Court began its analysis by noting that permanent compensation cannot be awarded until “it appears both that the partial incapacity is permanent and that the injury has reached maximum medical improvement.” The statute does not directly address whether loss of use is measured before or after surgical implantation.

The Court first faced a similar issue in the context of visual acuity. In the 1956 case of Owen v. Chesapeake Corp. of Virginia, when a claimant lost partial use of vision in an accident, the loss of use was determined based on the claimant’s vision without the use of glasses. The Court parlayed this analysis into a 1993 decision, Creative Dimensions Group v. Hill: an intraocular lens implant also warranted a loss of use rating prior to the implant.

In the case at hand, the Court analogized the implantation of claimant’s hip replacement to the corrective devices in the two cases above. The Court noted that the procedure comes with the expectation that the prosthetic will eventually fail and require subsequent surgical revision, so the claimant would be limited for the rest of his life.

The Court was unpersuaded by Loudoun County’s arguments that this would create a windfall for claimants who receive the benefit of full use of the limb while also receiving permanency benefits. The Court also did not agree this stretched the definition of “maximum medical improvement,” but only did so because the finding of MMI status was a factual determination, and the Court would not disturb the same on appeal.

Justice Kelsey issued a lengthy dissent, with whom Justice Powell joined. Justice Kelsey found an absurdist result, that the claimant continues to suffer a 74% loss of use of his leg, when he clearly does not. Justice Kelsey discussed a number of issues with the majority opinion, including disagreement with the majority’s legislative-acquiescence presumption. He also took issue with the notion that the claimant reached maximum medical improvement: “put another way, Richardson’s 74% incapacity would have been permanent had it not been temporary.”

Takeaway: This case further muddies the waters on what it means for a claimant to be at “maximum medical improvement.” The trend, both from the Commission and from the higher Courts, is to err on the side of compensation even when it leads to claimants receiving a windfall.

Any questions regarding this case can be directed to Mike Bliley, Esquire, at (571) 464-0435 or mbliley@tthlaw.com.

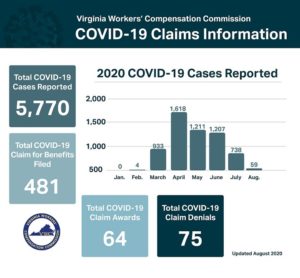

Virginia Workers’ Compensation Commission Releases Statistics on COVID-19 Claims

The VWCC has published statistics surrounding the 5,770 COVID-19 cases that have been reported to the Commission.

VA WCC COVID CLAIMS INFO

Roughly 1-in-12 of these cases have resulted in claims being filed. However, it is worth noting that the Commission has still denied over 50% of such claims. Without legislation specifically addressing the virus in Virginia workers’ compensation contexts, as has been implemented in other states, claimants still bear the high burden of proof for occupational diseases.

There are not yet any appellate decisions from the Full Commission on COVID-19 cases, but it is likely that Opinions will likely begin being issued within the next month or two.

Questions regarding the compensability of COVID-19 in Virginia can be directed to Mike Bliley, Esquire, at (571) 464-0435 or mbliley@tthlaw.com.